Fintech & NBFC Regulatory Lawyers in Kochi

India’s financial services sector is undergoing rapid transformation, with fintechs, digital lenders, and Non-Banking Financial Companies (NBFCs) playing a central role. In Kerala, fintech innovation is expanding across digital payments, peer-to-peer lending, and embedded finance. However, these opportunities come with strict regulatory oversight from the Reserve Bank of India (RBI) and other regulators.

Fintechs and NBFCs must operate within legal boundaries to avoid penalties, protect customers, and maintain investor confidence. Proper legal structuring, licensing, and compliance frameworks are essential for sustainable growth.

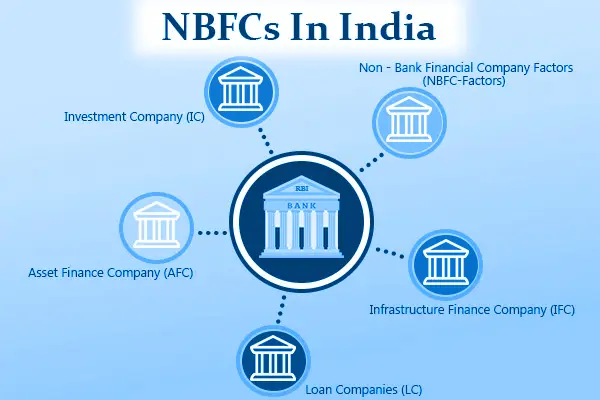

Regulatory Framework for NBFCs

NBFCs are regulated primarily by the RBI. Core compliance requirements include:

- Registration as NBFCs under RBI guidelines

- Minimum capital adequacy and net owned fund requirements

- Prudential norms on asset classification and provisioning

- Fair lending practices and borrower protection norms

- Periodic reporting and disclosure obligations

Failure to comply with RBI norms can lead to penalties, restrictions, or cancellation of NBFC licenses.

Fintech Legal & Compliance Requirements

Fintechs often operate at the intersection of technology and financial regulation. Key compliance areas include:

- Digital lending: Following RBI’s 2022 guidelines on loan apps, outsourcing, and customer disclosures

- Payments & wallets: Licensing under the Payment and Settlement Systems Act

- Data protection: Compliance with India’s Digital Personal Data Protection Act and RBI data security norms

- KYC/AML obligations: Adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) standards

- Outsourcing: Contracts with third-party service providers must comply with RBI’s outsourcing of financial services framework

Contracts in Fintech & NBFC Operations

Fintech and NBFC operations require enforceable contracts with customers, vendors, and partners.

Examples include:

- Loan agreements and recovery frameworks

- Technology outsourcing agreements

- White-label partnership agreements

- Service level agreements with payment gateways

- Data-sharing and privacy contracts

Clear drafting ensures compliance and protects against liability.

Investor Due Diligence in Fintech

Investors scrutinise fintech companies for:

- Valid RBI registrations or licenses

- Robust KYC and AML frameworks

- Clear technology and outsourcing contracts

- IP ownership for proprietary platforms

- Absence of regulatory violations

Regulatory weaknesses often delay or reduce funding rounds.

Litigation & Enforcement Risks

Non-compliance may result in:

- RBI penalties or business restrictions

- Customer litigation over mis-selling or fraud

- Investigations under IT and AML laws

- Contractual disputes with vendors or lenders

Prevention through compliance is far less costly than facing enforcement action.

FAQs – Fintech & NBFC Regulatory

Q1. Do fintechs need RBI approval to operate?

Yes, depending on the business model. Digital lending, wallets, and payment services often require RBI approval or licensing.

Q2. What is the minimum capital required to start an NBFC?

Currently, NBFCs must maintain a minimum Net Owned Fund (NOF) of ₹10 crore, though sector-specific requirements may apply.

Q3. Can fintechs outsource services like loan processing?

Yes, but outsourcing must comply with RBI’s outsourcing guidelines, and the regulated entity remains responsible for compliance.

Q4. How does data protection affect fintechs?

Fintechs must comply with both RBI’s data localisation requirements and India’s DPDPA, ensuring secure handling of personal and financial data.

Closing Note

Fintech and NBFC regulation is evolving rapidly, and compliance is critical for both survival and growth. By aligning operations with RBI frameworks, drafting compliant contracts, and preparing for investor scrutiny, Kerala’s fintechs and NBFCs can scale confidently while avoiding legal risks.